The Narcissism And Psychopathy Of Seizing Trump’s Assets

Attorney General Letitia James could freeze the Republican front-runner’s bank accounts, thus interfering in the presidential election, and rattling financial markets

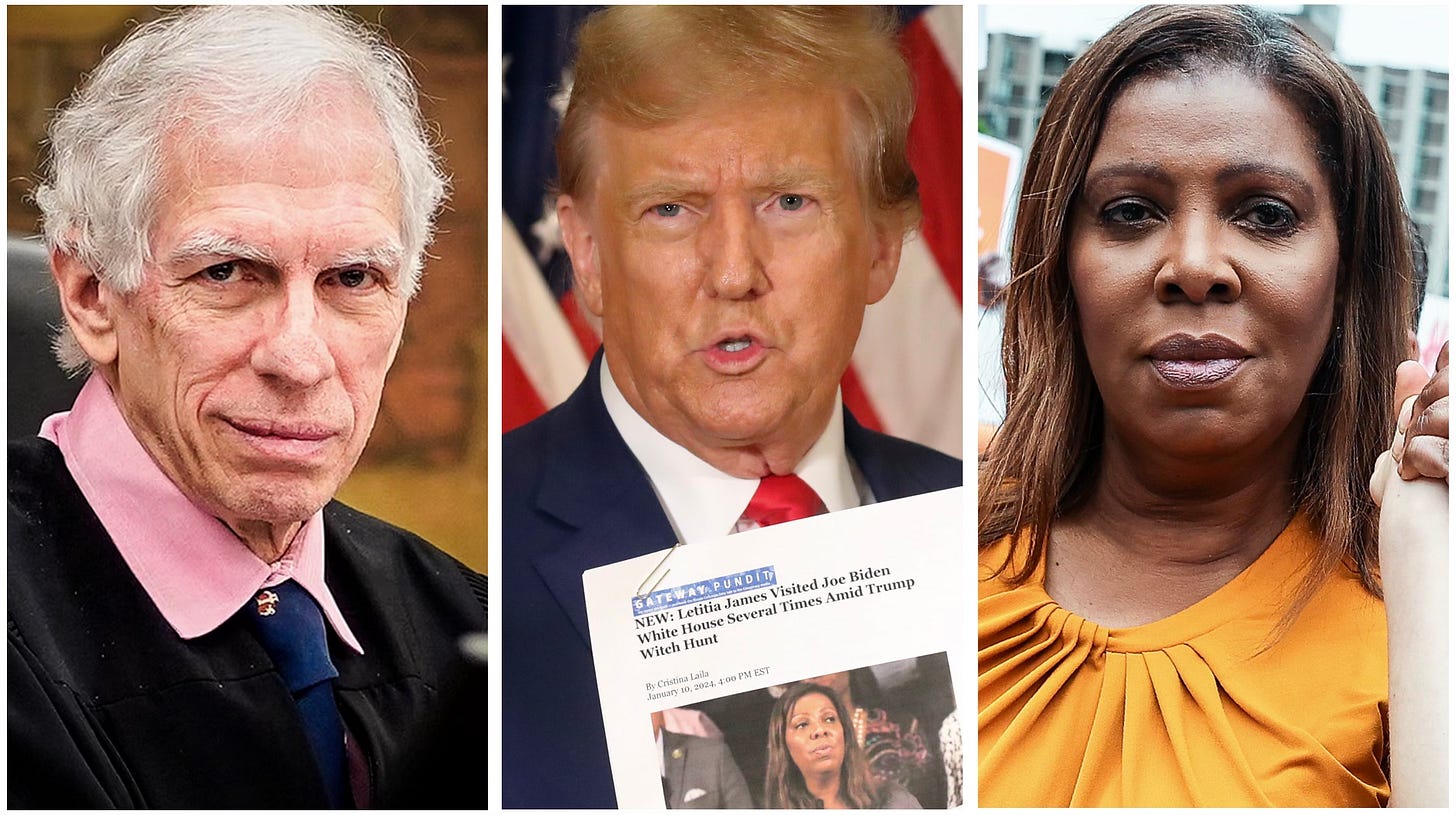

Former president Donald Trump committed fraud for years by lying about his wealth on financial statements to get favorable loans, say Democrats and New York Attorney General Letitia James. Judge Arthur Engoron ruled last month that Trump must pay over $354 million in damages, which has since increased to $464 million due to interest. Trump now has until Monday to post a bond. If he fails to do so, James can begin seizing his assets, including his bank accounts and properties.

“There’s not only potential asset seizures that could take place,” reported New York Times investigative journalist Susanne Craig on MSNBC yesterday. “He’s got some cash. His bank accounts could be frozen… If someone’s going to start a seizure process, they’re going to grab the most liquid thing, which is the cash.”

But Trump’s alleged fraud was victimless. The New York Times reported that Trump's bankers “testified that they had been delighted to have Mr. Trump as a client.” And, testified a banker in Deutsche Bank’s wealth management group, “It’s not unusual or atypical for any client’s provided financial statements to be adjusted to this level, or this extent.” Indeed, in 2013, the bank adjusted Trump’s net worth from the $4.9 billion he reported to $2.6 billion.

Judge Engoron, who was elected in 2015 and serves until 2029, argued that even if the bankers had no issues with the loans, “The mere fact that the lenders were happy doesn’t mean that the statute wasn’t violated, doesn’t mean that the other statues weren’t violated.” Trump could have committed fraud even if the bank did its own analysis of his finances.

But such alleged asset inflation is not uncommon, and James’ prosecution of Trump appears to be politically motivated. In 2018, James promised to “focus on Donald Trump” and “follow his money” if elected. She called him a “con man” and “carnival barker.” After her election, James said, “We will use every area of the law to investigate President Trump and his business transactions and that of his family as well.”

Seizing Trump’s cash and properties could have significant repercussions, warn business leaders. “I don’t think this case is about Trump anymore,” said investor Kevin O’Leary on CNN. “I think this case is about New York. It’s about the American brand. It’s about what we promised the world in terms of fairness and justice and investing capital in the country that’s built the largest economy on Earth. Forfeiture? Seizing of assets? Is that in our nomenclature in America? Is that what we tell people who want to bring their money here and protect property rights? Forget about Trump. Nothing to do with Trump. You think this is good for business in New York? You think this is good for business in America?”

And the bond is unprecedented and punitive. “There is no such thing as half a billion bonds,” said O’Leary, who is famous for his role on the TV investment reality show, “Shark Tank.” “Never been done before. Never. This law has never been applied.”

Democrats’ overreach could backfire and help Trump gain more support. After all, it would be easy for Trump to make the case that the courts are interfering in the election by freezing his bank accounts, which contain the cash he said he would spend on his presidential re-election campaign. ”I think we’re going to be writing an obituary of the Trump Organization,” said the Times’ Craig.